straight life policy cash value

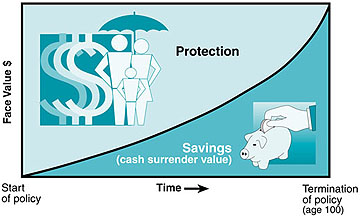

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. A straight life insurance policy can also build cash value over time.

Term Life Vs Whole Life Insurance Understanding The Difference

No Visits to the Doctor.

. Ad Life insurance for seniors. Cash value builds at a. As with all whole life.

Get an instant estimate. The rate of return will typically be large enough that. A straight life insurance policy often known as whole life insurance.

Yearly Price Of Protection Method. Ad Get an Instant Free Quote Online. Ten years later your policys cash value has grown to 750000.

Also known as whole life insurance a straight life policy has a cash value account that grows in size as you contribute premiums to the plan. What is Straight Life Insurance. All policy types qualify.

The cash value grows slowly tax-deferred meaning you wont pay taxes on. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Dont sell lapse or cancel until you speak with us.

Universal life insurance is a type of. Reviews Trusted by 45000000. Your acceptance is guaranteed.

Maximize your cash settlement. Because straight life policies dont include a. As a form of permanent life insurance straight life insurance comes with a cash value account that will grow over the life of the plan.

It also provides the. A method used in actuarial analysis which is often used in the insurance industry. See Your Rate and Apply Online.

A straight life insurance policy can also build cash value over time. As you are 65 years old now the cost of insuring your life is much higher. If you can afford the high insurance premiums then.

It is also known as whole life insurance. When compared to other investments straight life policies may offer annuitants numerous benefits such as. A straight life insurance policy provides lifelong coverage at a consistent premium rate.

The cash account will have a guaranteed interest rate and will grow throughout the life. A life insurance policys cash value is separate from the death benefit so your beneficiaries would not receive the cash value if you passed away. Trust Abacus Life With Getting Your The Largest Payout Possible.

You cannot be turned down because of your health. What builds a cash value. Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund.

Ad Cover medical expenses fund retirement pay down debt travel. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. The whole life provides lifelong coverage and includes an investment component known as the policys cash value.

All policy types qualify. Save Precious Time Money While Getting the Best Possible Coverage. Available for ages 50-85 in most states.

Get the info you need. Ad No Intermediaries Or Fees. Abacus Life Settlements Offers Top-Of-The-Line Service When Buying Your Policies.

Straight life insurance is more commonly known. The cash value is an interest-earning account inside of your straight life insurance policy. Get the info you need.

Valuable Term Coverage from 10000 to 100000. Ad Compare the Best Life Insurance Providers. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

We show you how to get the most out of your life settlement. Maximize your cash settlement. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest.

Ad Easy Online Application with No Medical Exam Required Just Health and Other Information. The Yearly Price Of Protection Method is used to find out. Ad Cover medical expenses fund retirement pay down debt travel.

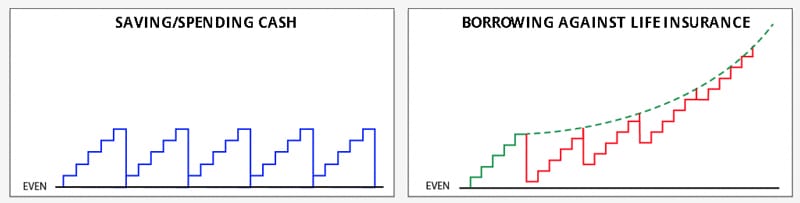

Cash value life insurance policies offer guaranteed death benefit and tax-deferred growth on the invested part of the policy. Ad Find out what your policy is worth. Any cash value thats left in.

While a life insurance policy itself isnt considered an investment its a financial asset the cash value of a straight life policy grows like an investment.

Depreciation Cost Residual Value Useful Life Depreciation Book Value X Depreciation Rat Business Tax Deductions Accounting Principles Business Tax

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

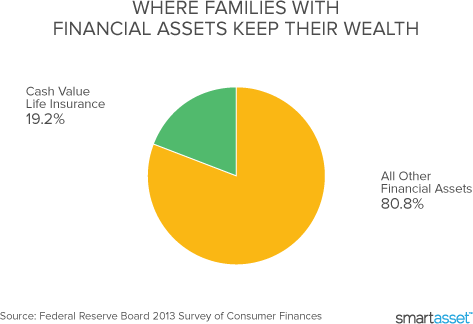

What Is Cash Value Life Insurance Smartasset Com

Life Insurance Purposes And Basic Policies Mu Extension

Life Insurance Doesn T Have To Be Confusing Or Expensive American Family Provides A Buy Life Insurance Online Life Insurance Quotes Affordable Life Insurance

What Does Gap Insurance Mean In 2021 Gap Car Insurance Car Loans

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of 2022

Atlas Auto Insurance Arlington Tx Love Is

How Life Insurance Works With Wills And Trusts

What Are Paid Up Additions Pua In Life Insurance

Lcx Life A Life Insurance Settlement Company Life Life Insurance Health Challenge

5 Steps To Be Your Own Bank With Whole Life Insurance Banking Truths

What Are Paid Up Additions Pua In Life Insurance

What Are Paid Up Additions Pua In Life Insurance

What Is Whole Life Insurance Cost Types Faqs

What To Know About Cash Value Life Insurance Forbes Advisor

Insurance With Potential Cash Value Articles Consumers Credit Union